ira 401k contribution limits

The IRS on Friday announced a record increase in contribution limits to 401k and other tax-deferred retirement plans for 2023. Taxpayers who contribute to individual retirement accounts IRAs can put away an extra 500 starting in.

|

| Rlpn2hjafxcfxm |

The IRA contribution limit is 6500.

. 2 days agoThe IRS will lift the maximum contribution limit to employee 401k accounts by 2000 next year to 22500. The contribution limit for a SIMPLE IRA which is a retirement plan designed for small businesses with 100 or fewer employees is also increased for 2023. The IRA catch-up contribution limit will remain 1000 for those age 50 and older. IRA Contribution Limits Bonus Contribution Details if Married.

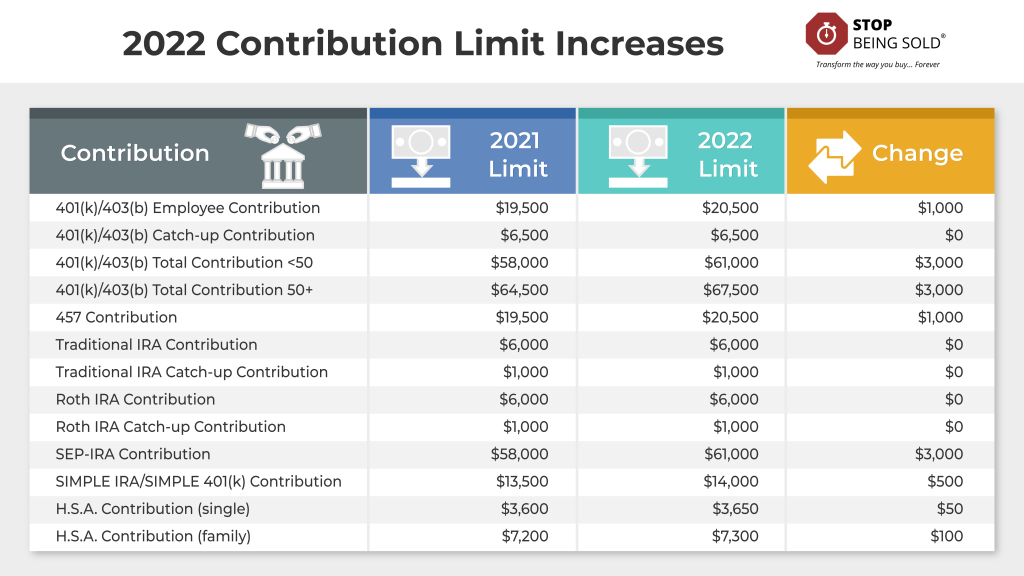

Married couples filing jointly can each make the maximum contribution to an IRA. The contribution limit for employees who participate in 401k 403b most 457 plans and the federal governments Thrift Savings Plan is increased to 22500 up from. If you participate in a retirement plan at work such as a 401k your IRA deduction may be limited based on your income. Has increased by 1000 setting the limit at 20500 for 2022 contributions.

SIMPLE 401k or SIMPLE IRA age 50 catch-up contributions limit. In 2022 you can contribute up to 6000 or your taxable compensation and in 2023 you can contribute up. Roth IRAs have the same annual contribution limits as traditional IRAs. Accordingly there are big changes.

Although you can contribute 6000 or 7000 if youre 50 or. The Internal Revenue Service is raising contribution limits for tax-deferred retirement plans by a record 98 for 2023 because of inflation. The new 22500 and 30000 limits apply to employee contributions that are made either pre-tax or to a Roth account in a 401k plan or to similar plans maintained by non-profit. That brings the total contribution limit for those 50 and older to 30000.

401k participants with incomes below 83000 136000. IRA Deduction Limits for 2023. In addition those over 50 years of age can make additional catch-up contributions of 7500 per year 30000 in. For people aged 50 and older who are nearing retirement the.

Retirement savers with a 401 k 403 b most 457 plans and the federal governments Thrift Savings Plan can contribute up to 20500 in 2022 a 1000 increase from. For 2022 the annual deferral or contribution limit for 401k 403b etc. The inflation-adjusted employee contribution limit for 401ks. 401 k and IRA contribution limits for 2023.

One of the indirect benefits of high inflation is that the annual Solo 401k contribution limits have increased significantly from 2022. Starting next year Americans will be able to contribute 22500 to their 401 k plans up from 20500 this year a bump of nearly. Remember that annual contributions to all of your accounts maintained by one employer and any related employer - this includes elective deferrals employee contributions. Here are the 2023 401k and IRA contribution limitsinvestors can save a lot more next year.

SIMPLE 401k or SIMPLE IRA contributions limit. But the IRA catch-up contribution limit stays. 401k employee contribution limits increase in 2023 to 22500 from 20500.

|

| 401 K Vs Traditional Ira Vs Roth Ira Vs Myra Human Interest |

|

| 401 K Max Contribution Limit Increased To 20 500 Starting In 2022 |

|

| 2023 401k Contribution Limits Unprecedented Increase Projected 401 K Specialist |

|

| Retirement Plan Contribution Limits Will Increase In 2020 Ward And Smith P A Jdsupra |

|

| Major 2023 401k Contribution Limit Jump Predicted 401 K Specialist |

Comments

Post a Comment